Potential Program

During the 1990’s through the first five years of the 21st century, wood producers experienced healthy volume sales as demand for new, and bigger homes expanded at an unprecedented rate.

During the 1990’s through the first five years of the 21st century, wood producers experienced healthy volume sales as demand for new, and bigger homes expanded at an unprecedented rate.

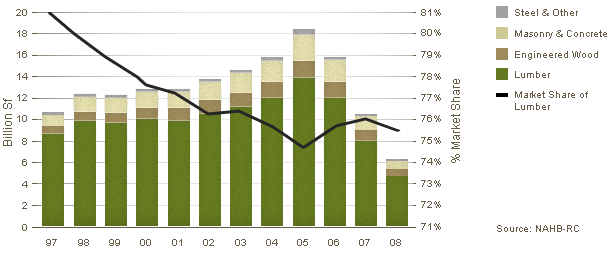

However, underneath the surface of solid volume sales, wood was experiencing erosion of market share to competing products, especially concrete, composites, steel and vinyl. This share erosion may have not been felt as acutely as it would have been in a flat market; nevertheless, the lost volume was worth several hundred millions of dollars over a five year period.

U.S. Residential New Material Construction (Single & Multi-family)

Structural Materials - Floors, Walls, & Roofs

At the same time, while modest growth was occurring in the non-residential market, a case can be made that wood lost opportunity by not pursuing an aggressive, coordinated, North American-wide marketing strategy to take market share from concrete and steel.

For most of the last two decades, wood has also been the subject of attacks on the basis of whether using wood was an environmentally appropriate choice. While these attacks may not have created share or volume losses, they increased the cost of doing business and were a source of distraction, as softwood lumber producers and their associations needed to work to rebut these attacks.

Today, the softwood lumber products sector enjoys an unprecedented opportunity to create volume growth opportunities, because of two important, new factors:

- There is an unprecedented openness to changing building practices, tied in large part to the widespread interest in sustainable or green building and climate friendly products.

- Softwood lumber from sustainably-managed North American forests possesses unique credentials as a sustainable product, especially when compared to steel, plastic, composites and concrete.

Given this set of circumstances, the BRC Program Committee recommends the establishment of a long term strategic program to market wood and increase the volume of softwood lumber sold, softwood’s market share and returns in several important markets. Subject to refinement, the broad outlines of the program we recommend are:

Duration

Based on the lessons learned from the now defunct Wood Promotion Network, we believe that for a program to succeed, it must be backed by predictable and appropriate funding for more than 5 years. Equally important, program focus and strategies need to remain largely consistent for that period to ensure optimum results.

Objectives

The priority objectives of the program would be:

- Stop further erosion of market share in single family residential markets

- Increase wood’s share in multi-family residential construction

- Significantly increase wood use in non-residential markets

- Defend and rebuild share in the outdoor living market

Based on research, these markets offer the greatest opportunity for softwood lumber products. The multi-family and non-residential markets have a potential of $2 billion per year while outdoor living and single family residential markets can add more than $1 billion per year.

While not an element in the initial phase of the program, an opportunity exists for the North American industry to collaborate in an effort to grow demand in offshore markets. A unified approach between the Canadian and US industries would attract significant leveraging opportunities through the US FAS program and NRCAN’s Canada Wood Export Program.

Target Audience

Based on the objectives described above, and what past research tells us about how decisions are made in these markets, we would expect that at least 70% or more of the effort in this promotional program would be targeted to trade and elite audiences. Consumer-related promotion would be limited to no more than 30% of the program and be focused primarily on the use of softwood lumber products for outdoor living applications.

Strategies

The recommended strategy involves establishing a clear and consistent brand positioning for wood as the product that is the most practical, affordable and sustainable choice for use in all of these markets. This would be done through a blend of over-arching brand promotion-style communications targeted at those markets and audiences most critical to success, along with extensive, on-the-ground programs of trade relations, events, and education, all targeted to the key decision makers and influencers who can result in more specification of wood.

Within the context of this strategy, significant efforts would be made to harness the growing interest in sustainable building to ensure helpful changes in codes where necessary, and a much higher awareness of the environmental advantages of using wood. The goal would be to ensure that wood is seen as the most logical green choice, especially for the construction professional or corporate executive who wants to blend practicality, affordability and sustainability.

Leveraging/Co-op

The wood industry has the potential to leverage financial and support from allies, customers, and related businesses. We recommend that the program design include extensive efforts to secure financial support from appropriate government agencies, as well as from organizations that rely on a thriving wood products sector, such as wholesalers, retailers, transportation companies, tool and fastener companies and labour unions to name just a few. It is realistic to assume that a leveraging ratio of 2:1 could be achieved in the first five years of the program.

In addition to financial leverage, the Committee recommends that significant effort be devoted to leveraging communications support to extend the reach, frequency and impact of our program. This would include co-op materials for use by, and creating alignment among, industry members, all related associations, and for delivery into retail markets through commercial and residential builders, architects, designers and retailers.

Program Delivery

Based on past experience, it is clear that several things are pre-requisites of success for an initiative such as this. The most important are as follows:

- The program would be designed to run as a virtual, entrepreneurial initiative, rather than as a new association. In effect, it is an investment in institutionalized category marketing, rather than an institution to do category marketing.

- It is imperative to have high level, ongoing commitment on the part of industry members. This ensures continuous alignment of campaign strategy with industry business objectives.

- Measurement of progress against outcomes as well as measurement of the efficacy of strategy and tactics is a critical component of good governance and exceptional marketing communications. This initiative should be supported with solid metrics and measurement tools.

From an operational standpoint, there would ideally be two governance mechanisms, with operational activities outsourced. At the top would be a CEO level Steering Committee, supported by a Wood Marketing Task Group of industry professionals, whose time would be contributed to the effort by their respective employers.

Potential Program Elements - Overview

| Program | Target Audience |

Key Elements |

Green Building |

Architects/Trade |

Education |

Non Residential |

Architects |

Education |

Outdoor Living |

Consumer/Trade |

Education |

Residential – Multi Family |

Architects/Trade |

Education |

Residential – Single Family |

Builders |

Education |

Benchmarking |

Industry |

Statistical Reporting |